J.W. Cole Financial is required to make available quarterly reports that present a general overview of our routing practices. These reports identify the significant venues to which customer orders were routed for execution during the applicable quarter.

J.W. Cole Financial transmits customer orders to our clearing firm, National Financial Services, LLC (NFS), Member NYSE/SIPC. NFS may then route these orders to various venues for execution.

Click here to view J.W. Cole's most current routing order information.

Previous routing order information can be found below. Customers of J.W. Cole may also request in writing a printed copy of this report.

2024

PDF Q1 Q2 Q3 Q4

XML Q1 Q2 Q3 Q4

2023

PDF Q1 Q2 Q3 Q4

XML Q1 Q2 Q3 Q4

2022

PDF Q1 Q2 Q3 Q4

XML Q1 Q2 Q3 Q4

2021

PDF Q1 Q2 Q3 Q4

XML Q1 Q2 Q3 Q4

J.W. Cole Financial, Inc. is a member of both the Financial Industry Regulatory Authority (FINRA) and the Securities Investor Protection Corporation (SIPC).

Securities in accounts carried by National Financial Services, LLC (NFS), a Fidelity Investments® company are protected by SIPC up to $500,000 (including cash claims limited to $100,000). NFS has arranged for additional protection for cash and securities to supplement its SIPC coverage. This additional protection carried by NFS covers total account net equity in excess of the $500,000/$100,000 coverage provided by SIPC. Neither SIPC nor the additional coverage protects against loss of market value of the securities.

In accordance with the FINRA Conduct Rule 2342, regarding SIPC information, please know that you may contact SIPC for additional information at (202)371-8300 or visit them on the Web at www.sipc.org.

The Bank Deposit Sweep Program (BDSP) is a core account investment vehicle used for customer cash balances.

Through the BDSP, cash balances from securities transactions, deposits, dividend and interest payments, and other activities in a brokerage account, are automatically deposited or swept into interest-bearing FDIC insurance-eligible Program Deposit Accounts (PDA) at one or more FDIC-insured financial institutions. Cash remains in the PDA until it is reinvested or withdrawn.

FDIC insurance coverage is $250,000 per depositor, per insured depository institution for each account ownership category.

Individual investors, and trustees acting on behalf of individual investors, are responsible for monitoring the total amount of deposits at each program bank to determine if they exceed the limit of available FDIC insurance.

! Important: Read the Bank Deposit Sweep Program disclosure document carefully for information on:

For programs that sweep to more than one bank, the Program Bank List specifies the program banks into which funds will be deposited, and the order of the program banks that will receive a customer's funds.

Program banks are organized into regional bank lists and the order in which banks are used for deposit may vary by region. Each customer is provided a bank list based upon the customer's state as reflected in a customer's account mailing address. The customer can identify his or her state by looking at one of the following:

The Program Bank List may be included in the program disclosure. It may also be obtained from your Home Office, or your firm's Web site, if applicable.

Note: It is the customer's obligation to review the banks into which funds will be deposited as the customer is responsible for monitoring the total amounts he or she has on deposit at each program bank that may be eligible for insurance by the FDIC.

The listed fees do not include commissions, markups, commission equivalents or advisory fees. These fees apply to brokerage accounts held at NFS. Some fees may not apply to all brokerage account types.

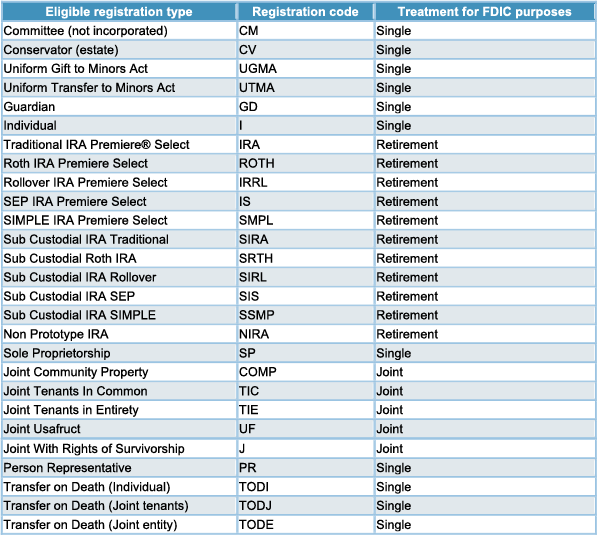

To be eligible, each account owner must be a natural person, acting for himself or herself or on behalf of a trust where each beneficiary is a natural person. The Bank Deposit Sweep Program (BDSP) is available for:

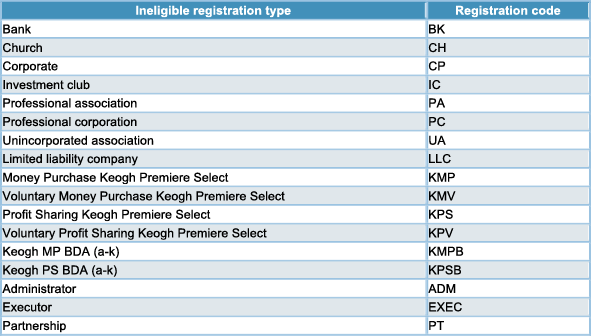

The BDSP is not available for:

The following account registration types are systematically blocked from establishing a bank deposit core sweep:

For additional information, please visit FDIC.